Why the buyers focused on insight—not inventory—will own the next decade.

For years, the debt-buying space was obsessed with volume.

Brokers bragged about “how many files they could move.”

Buyers bragged about “how many accounts they could take down.”

Agencies bragged about “how many calls their dialer could pump out.”

But the truth finally caught up with the industry:

Quantity doesn’t drive ROI anymore.

Quality of insight does.

The shops still chasing “cheaper paper” are the same ones:

-

Missing hidden risk pockets

-

Overpaying for polluted portfolios

-

Working the wrong accounts first

-

Burning collectors out

-

Blaming agencies instead of data

-

Holding portfolios that were doomed from the start

Meanwhile, the operators who understand smart paper—enriched, segmented, economically scored, and strategy-aligned—are out-earning everyone else.

This is the new divide.

And it’s widening fast.

Cheap Paper Is a Trap — Smart Paper Is an Advantage

Let’s be blunt:

Cheap portfolios are cheap for a reason.

It’s never because the seller “just wants it gone.”

It’s because:

-

Documentation is weak

-

Geography is toxic

-

Debtor quality is questionable

-

Prior placements underperformed

-

Economic conditions are deteriorating

-

Balance-to-income ratios are misaligned

-

State mix is unworkable

-

Data is contaminated

A $0.03 file that never liquidates is more expensive than a $0.12 file that performs above curve.

Smart operators know this.

Smart operators lean into smart paper—assets enriched with insights that forecast future value, not just show past balances.

The Rise of Enriched Data: The REAL Competitive Advantage

Enriched paper isn’t a buzzword.

It’s a measurable, monetizable advantage.

Here’s what separates smart paper from raw paper:

✅ 1. Geographic Intelligence (ESI)

A debtor’s ability to pay is tied directly to:

-

Local unemployment

-

Household income

-

Housing affordability

-

Cost-of-living pressure

-

Wage-to-rent ratios

-

Economic mobility

Yet 80% of buyers still price without it.

That’s like trading stocks without knowing the market.

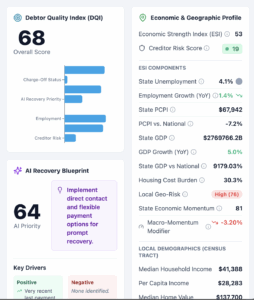

Debt Catalyst fixes this using the Economic Strength Index (ESI), blending:

✅ BLS unemployment

✅ BEA income

✅ Census micro-data

✅ Housing affordability scoring

Suddenly, the same $2,200 balance looks very different depending on where the debtor actually lives.

✅ 2. Debtor Quality Index (DQI)

DQI identifies the characteristics of a high-value debtor profile:

-

History of repayment

-

Prior placement performance

-

Creditor underwriting quality

-

Balance-to-signal ratios

-

Documentation completeness

-

Behavioral indicators

-

Trailing account patterns

Most buyers look at balance and charge-off date.

DQI looks at recoverability—the only thing that matters.

✅ 3. AI Recovery Blueprints

This is the biggest flip in the entire ecosystem.

Instead of buyers saying:

“We’ll figure out how to work it later.”

Debt Catalyst automatically generates a Recovery Blueprint for every segment:

✅ Settlement-first

✅ SMS-heavy

✅ Self-service portal

✅ Litigation-ready

✅ Dialer-priority

✅ Contact-minimum

✅ Skip-heavy

✅ Affordability-matched

It doesn’t just tell you what you bought.

It tells you how to work it for maximum ROI.

✅ 4. Segment-Level ROI Forecasting

Old-school buyers price based on portfolio-wide liquidation assumptions.

Modern buyers price based on:

-

Best-performing deciles

-

High-yield clusters

-

Strategy match rates

-

Risk-adjusted curves

-

Expected variance

-

Agency alignment

You don’t need a file to average 8% liquidation.

You need 30% of the file to liquidate at 18%.

That’s the difference between guessing and modeling.

Smart Paper Creates Alpha — Cheap Paper Creates Headaches

Here is the truth nobody says out loud:

Smart paper reduces operational waste.

Smart paper shortens liquidation cycles.

Smart paper lowers compliance risk.

Smart paper increases return multiples.

Smart paper produces consistent curves.

Cheaper paper?

It gives you:

-

More disputes

-

More dead ends

-

More agency turnover

-

More compliance exposure

-

More wasted labor

-

More charge-off stagnation

-

More negative ROI surprises

Cheap paper destroys margins.

Smart paper builds them.

Debt Catalyst: The Smart Paper Engine

Debt Catalyst was engineered to transform any raw portfolio into a fully enriched, investment-grade asset:

✅ Ingestion → Auto-mapped & validated

✅ Enrichment → ESI + DQI + AI segmentation

✅ Strategy → Recovery Blueprint generated instantly

✅ Valuation → Risk-adjusted pricing

✅ Performance → Real-time tracking

✅ Feedback loop → Recalibrate future bids

It eliminates the 20 years of “tribal knowledge guesswork” and replaces it with:

-

Precision

-

Predictability

-

Transparency

-

Speed

-

Repeatability

This is the operating system for the next generation of buyers.

Final Word: Don’t Chase Cheaper Paper.

Demand Smarter Paper.**

This industry doesn’t reward the buyers who take down the most accounts.

It rewards the ones who understand the true economic value of the paper they buy.

The future belongs to the buyers who:

✅ Understand geography

✅ Price risk intelligently

✅ Segment accounts strategically

✅ Predict liquidation accurately

✅ Use AI as a multiplier

✅ Bet on data, not bravado

Anyone can buy paper.

Few can buy smart.

And in the next 5 years, that gap becomes the entire game.

Why is the focus shifting from inventory quantity to insight in debt buying?

The industry is shifting from prioritizing volume to valuing insightful analysis because quality of insight now drives return on investment, unlike the past when quantity was the main measure.

What are the risks of continuing to chase cheaper debt portfolios?

Chasing cheaper portfolios often leads to overpaying for polluted assets, missing hidden risks, working unprofitable accounts, and incurring operational inefficiencies, which ultimately diminishes ROI.

How does enriched data provide a competitive advantage in debt buying?

Enriched data offers a measurable and monetizable advantage by adding geographic intelligence, debtor quality indices, AI-driven recovery blueprints, and risk-adjusted pricing, which lead to better decision-making and higher returns.

What is the significance of smart paper in debt collection strategies?

Smart paper, enriched with insights such as future value forecasts and risk factors, reduces operational waste, shortens liquidation cycles, lowers compliance risks, and increases return multiples, unlike cheap, polluted portfolios that cause operational issues.

What features does Debt Catalyst provide to transform raw portfolios into investment-grade assets?

Debt Catalyst automates ingestion and validation, enriches portfolios with geographic and debtor data, generates strategies and recovery blueprints, provides risk-adjusted valuation, tracks performance in real-time, and recalibrates future bids for optimized results.